FAQs

FAQs

Please reach us at clearance@procustoms.co.uk if you cannot find an answer to your question.

An EORI is a unique identifier for importers and exporters in the UK issued by the EORI team at HMRC. It is needed to process import and export declarations for traders. If you do not have an EORI and want to start importing or exporting you will need to obtain an EORI as one of the first things you do. The link to do so is below.

Postponed VAT Accounting allows for an importer to account for import VAT on their VAT return rather than having to pay it up front on import. One of its main benefits is helping a business with cashflow, for more information please see the below link.

https://www.gov.uk/guidance/check-when-you-can-account-for-import-vat-on-your-vat-return

CDS stands for the “Customs Declaration Service” and is the new HMRC customs system replacing the Customs Handling of Import and Export Freight (CHIEF). From the 1st of October 2022 all import declarations will need to be submitted through CDS (March 2023 for export declarations). Importers MUST have subscribed to CDS before this date and are advised to do so as soon as possible to ensure there are no issues with clearance of their goods. The link to subscribe is below.

https://www.gov.uk/guidance/get-access-to-the-customs-declaration-service

The commercial documents for the shipment will need to be supplied, this will be the commercial invoice and packing list as well as any relevant transport documents such as the Bill of Lading. If any license or certificates are relevant to the shipment these will also need to be supplied.

A commodity code is a classification of goods being imported and exported. In the UK the UK Global Tariff codes are used. The commodity code is needed for import and export entries to tell HMRC what the goods are so duties and VAT can be calculated. It is also needed to determine whether or not the goods are subject to prohibitions and restrictions. More information on commodity codes can be found in the below links.

https://www.gov.uk/trade-tariff

https://www.gov.uk/guidance/finding-commodity-codes-for-imports-or-exports

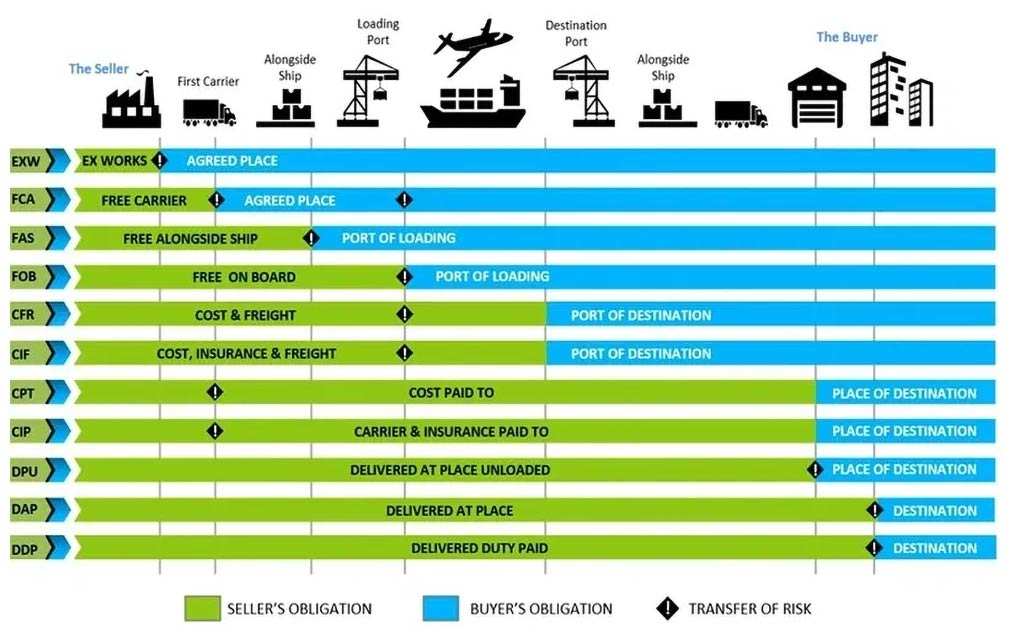

Incoterms are internationally recognized contract terms used in shipping to determine who is responsible for what and when risk is transferred, these are updated every 10 years and the current Incoterms are the 2020 version. When it comes to customs clearance of goods these terms are used to help determine the customs value for duty and VAT and therefore ensure the correct duties and VAT are paid on import. The below table gives a brief overview of the buyers and sellers obligations and transfer of risk for the 2020 Incoterms.

INCOTERMS 2020

Point of delivery & Transfer of Risk